404 Media will be hosting its fourth FOIA Forum for paid subscribers on July 31, 2024, at 1pm EDT. The main guest speaker will be Seamus Hughes, who runs Court Watch. See more details here.

Court opinion issued July 9, 2024

Court Opinions (2015-2024)CommentLovelace v. DOJ (D. Utah) -- recommending that court dismiss pro se plaintiff’s claim concerning FBI’s 2016 FOIA response, because plaintiff failed to file an administrative appeal with DOJ’s Office of Information Policy.

Summaries of all published opinions issued in 2024 are available here. Earlier opinions are available here.

FOIA News: OIP hosting workshop 7/31/24

FOIA News (2015-2024)CommentRegister Now for an Upcoming FOIA Best Practices Workshop on Backlog Reduction Plans

DOJ/OIP, FOIA Post, July 9, 2024

Join the Office of Information Policy (OIP) at its next Best Practices Workshop on creating and implementing backlog reduction plans. Developing effective backlog reduction plans is critical to managing ever-increasing volumes of requests. The workshop will feature panelists from agencies with varied FOIA workloads discussing their own backlog reduction efforts.

The workshop will take place virtually over WebEx on July 31, 2024 from 10 AM – 12 PM EDT. A summary of the best practices discussed will be posted on OIP’s Best Practices page.

This event is open to all agency FOIA professionals. Federal employees may register here.

For questions or more information, please contact OIP at DOJ.OIP.FOIA@usdoj.gov.

FOIA News: PTO defends Exemption 5 redactions

FOIA News (2015-2024)CommentPatent Office Continues To Fight Smartflash's FOIA Suit

By Adam Lidgett, Law 360, July 8, 2024

The U. S. Patent and Trademark Office has again said it shouldn't have to turn over documents an inventor is seeking about Patent Trial and Appeal Board reviews of his patents, saying that doing so would harm its ability to respond to public information requests. . . .

The federal government on Monday filed a reply brief backing its bid for summary judgment in the case filed y Smartflash LLC, which is owned by inventor Patrick Racz.

Smartflash had said the PTAB panels in its cases were manipulated to benefit challenger Apple, and the the documents it got from the office in response to its Freedom of Information Act requests omitted too much information to provide clarity. The company had said that the emails were improperly redacted and that it was treated differently from other patent owners, according to court records.

Read more here (access with free 7-day trial).

The docket and complaint are available here.

Court opinion issued July 3, 2024

Court Opinions (2015-2024)CommentHeritage Found. v. DOJ (D.D.C.) -- ruling that government reasonably searched for records pertaining to Robert Hunter Biden and did not act in bad faith, rejecting plaintiff’s argument that agency custodians were inappropriately tasked with searching their own records about their own alleged misconduct.

Summaries of all published opinions issued in 2024 are available here. Earlier opinions are available here.

Jobs, jobs, jobs: Weekly report July 8, 2024

Jobs jobs jobs (2024)CommentFederal positions closing in the next 10 days

Gov’t Info. Specialist, Dep’t of Def/OSD, GS 13, Alexandria, VA, closes 7/10/24 (non-public).

Gov’t Info. Specialist, Dep’t of the Navy, GS 9-11, Arlington, VA, closes 7/10/24 (non-public).

Gov’t Info. Specialist, Dep’t of Veterans Affairs/VHA, GS 11-12, closes 7/10/24 (non-public).

Gov’t Info. Specialist, Dep’t of Health & Human Serv./CMS, GS 14, Woodlawn, MD, closes 7/13/24 (non-public).

Gov’t Info. Specialist, Dep’t of the Army, GS 7-9, Fort Campbell, KY, closes 7/15.24 (non-public).

Sup. Gov’t Info. Specialist, Dep’t of State, GS 14, Wash., D.C., closes 7/18/24 (non-public).

Federal positions closing on or after July 19, 2024

Attorney Advisor, Dep’t of Justice/OIP, GS 12-15, Wash., D.C., closes 7/21/24.

Gov’t Info. Specialist, Dep’t of the Army, Nat’l Guard, GS 9, Frankfort, KY, closes 7/22/24 (non-public).

FOIA News: Happy 58th Anniversary

FOIA News (2015-2024)CommentJuly 4 — The 58th Anniversary of The Freedom of Information Act

By Floyd Nelson, Blue Ridge Leader & Loudoun Today, July 4, 2024

More than 50 years ago, Michael Ross Lemov was still a young, intrepid general counsel who had just finished working on the National Commission on Product Safety, the forerunner to the Consumer Product Safety Commission. That was the time he told me he started working for the late California Congressman John Moss, the primary author, the champion and the driving force behind the Freedom of Information Act.

Thus marked the beginning of a friendship, mentorship and joint commitment to American democracy and open government. Mind you, Moss had already single-handedly brought the Freedom of Information Act or FOIA into being in 1966.

Read more here.

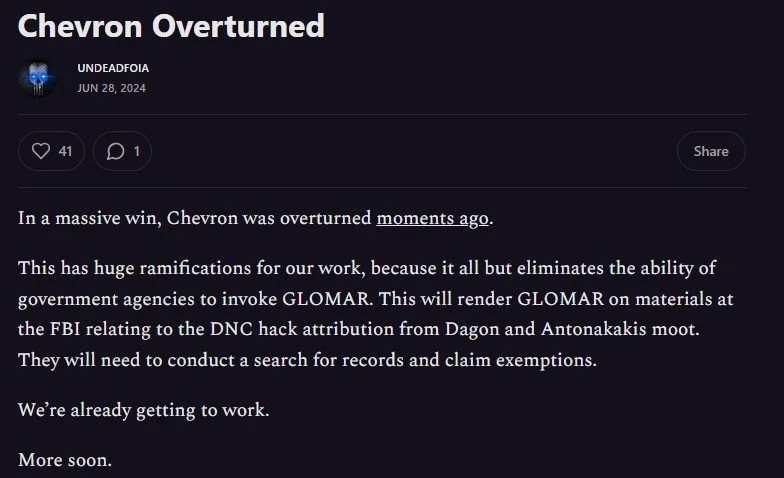

Commentary: Glomar is alive and well

FOIA Commentary (2017-2024)CommentOn June 28, 2024, the U.S. Supreme Court in Loper Bright Enterprises v. Raimondo overturned its 40-year-old Chevron doctrine, which the Court explained “sometimes required courts to defer to ‘permissible’ agency interpretations of the statutes those agencies administer—even when a reviewing court read the statute differently.”

In a hot take, Ryan Milliron, a FOIA blogger and frequent litigator, asserted that the Court’s decision would preclude federal agencies from issuing Glomar responses, that is, refusing to confirm or deny the existence of records sought under FOIA.

Mr. Milliron, a CPA by trade, is mistaken. FOIA Advisor’s Ryan Mulvey, lead counsel for the Cause of Action Institute team in the Loper Bright case, explains:

Chevron deference was never really relevant—with one possible exception, noted below—to judicial review under the FOIA. To start, the FOIA is clear that courts must adopt a de novo standard of review for all matters related to the withholding of an agency record. Such a standard isn’t expressly true, as a textual matter, for Section 706 of the APA, at least insofar as it pertains to questions of law. Second, and more obviously, no one agency is responsible for administering the FOIA, which applies across the federal government. See, e.g., Tax Analysts v. IRS, 117 F.3d 607, 613 (D.C. Cir. 1997). An agency wouldn’t even be able to get past “Step Zero” of the old Chevron regime. That was even the case with specific provisions that direct OMB to devise and publish uniform (i.e., government-wide) fee guidelines, too. OMB’s definitions simply weren’t entitled to any special deference. See Sack v. DOD, 823 F.3d 687, 692 (D.C. Cir. 2016); see generally Cause of Action v. FTC, 799 F.3d 1108 (D.C. Cir. 2015).

That said, things were always a bit tricky with Exemption 3, which cross-references withholding statutes that exist outside Section 552. As it stands, I believe there’s still a technical circuit split about whether or when deference to agency interpretations of the scope of an Exemption 3 statute are warranted. That split should now ostensibly resolve post-Loper in favor of good, ole’ de novo review across the board. Consequently, as with any question of statutory interpretation, a judge would provide his or her independent, best judgment about the scope of the withholding provision. And application of that statute in any particular FOIA case would (as before) be considered de novo.

As an aside, there are other kinds of ‘deference’ that exist in FOIA land, and which many requesters find troubling, especially given the statute’s promise of de novo review. Courts often afford significant deference to factual determinations set out in agency affidavits. Consider, for example, the language of “substantial weight” in Exemption 1 litigation, or the “good faith” and “regularity” presumptions in all cases. There’s also a radical uniqueness to FOIA and FOIA litigation that ends up giving de facto deference to the government. We might look to the the lack of an administrative record, the rarity of discovery, the multiple rounds of summary judgment so that agencies can get another bite at the apple, etc. Finally, the D.C. Circuit has decided to afford deference to an agency’s interpretation of its own regulations that provide for additional grounds for expedited processing beyond those set out in the statute. See, e.g., Al-Fayed v. CIA, 254 F.3d 300, 307 n.7 (D.C. Cir. 2001). (That, of course, implicates Auer deference, which is still good doctrine, albeit limited by Kisor v. Wilkie.) Loper Bright and the broader movement to reform the administrative state haven’t yet touched these kinds of concerns.

But to return to Mr. Milliron’s assertion, an agency that issues a Glomar response has only ever needed to persuade a reviewing court that acknowledging the existence or non-existence of requested information would constitute information that itself falls within a FOIA exemption. See, e.g., Schaerr v. DOJ, No. 21-5165, No. 2023 WL 3909471 (D.C. Cir. 2023). In evaluating such Glomar claims, as opposed to arguments about the scope of the underlying exemptions, courts were never required by Chevron to defer to agency legal interpretations. The matter was always de novo. Moreover, whatever factual deference might have been given to an agency’s affidavits would not have been required by Chevron. The recent abrogation of Chevron has absolutely no impact on Glomar responses, and it certainly doesn’t foreclose their use.

Congratulations to Mr. Mulvey and his colleagues at Cause of Action Institute, including FOIA Advisor’s Kevin Schmidt, on the landmark Loper Bright ruling.

Court opinion issued July 2, 2024

Court Opinions (2015-2024)CommentFogg v. IRS (8th Cir.) -- following in camera inspection, affirming district court’s decision that agency properly relied on Exemption 7(E) to withhold portions of section 21.1.3.3 of the Internal Revenue Manual, because the contents concerning third-party authentication are “techniques and procedures for law enforcement investigations and their disclosure could reasonably be expected to risk circumvention of the law”; further concluding that the agency met the heightened foreseeable harm standard, which the district court neglected to address.

Summaries of all published opinions issued in 2024 are available here. Earlier opinions are available here.

Court opinions issued July 1, 2024

Court Opinions (2015-2024)CommentLouise Trauma Ctr. v. DHS (D.D.C.) -- deciding that plaintiff was eligible and entitled to award of attorney’s fees, fees on fees, and costs regarding its requests for asylum-related records; for both factors, taking into account agency’s unexplained failure to produce any records in the year or more before litigation began; reducing plaintiff’s requested award for billing “some improper and excessive tasks,” and because “many of the time-keeping records lack sufficient detail to assure the Court that time was reasonably expended.”

Empower Oversight Whistleblowers & Research v. U.S. Dep't of Veterans Affairs (E.D. Va.) -- ruling that: (1) plaintiff’s claims regarding agency’s lack of timeliness were moot, plaintiff had no right to declaratory relief or attorney’s fees on those claims, and plaintiff failed to properly allege a “policy-or-practice” claim; (2) multiple components performed adequate searches for requested records related to inquiry by U.S. Senator Grassley about a senior-level agency employee; and (3) agency properly redacted certain information pursuant to Exemption 5 (DPP) and Exemption 6.

Summaries of all published opinions issued in 2024 are available here. Earlier opinions are available here.